fanduel winnings taxed|Sports Betting Taxes: How They Work, What's : Tagatay We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at . Tingnan ang higit pa Understanding Qualifying Bets is one of the most important aspects of Matched Betting. Read the Qualifying Bet Finder introduction before continuing. With some Qualifying Bets, the reward is based on the amount that you win. For example, “double your winnings” or “receive Site Credit up to 50% of the winnings.”

fanduel winnings taxed,We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit paFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 . Tingnan ang higit pa

FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. . Tingnan ang higit pa

Fanduel winnings can come with tax implications, so it’s always beneficial to plan accordingly. Use the information provided here, along with professional tax advice, . Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year . If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .

Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, . Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to . But whether you're wagering on the World Series from your couch or flying to Las Vegas for a weekend at the tables, you'll have to pay taxes on your winnings. FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off .fanduel winnings taxed Sports Betting Taxes: How They Work, What's TVG - Taxes, W2-Gs & Year End Reports. Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in . Put it this way: If you won an equal amount of money at DraftKings and FanDuel (or any of its competitors), your winnings would be reported and taxed the same.

Whether it's $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other income" on Schedule 1 (Form 1040). If .

Every time bettors lose a $1,100 bet, they lose $1,100. But every time sportsbooks lose a $1,100 bet, they only lose $1,000. So if a bettor makes 10 wagers of $1,100 each and goes 5-5 on those .After you’ve received all your W-2G forms, you need to transfer your total gambling winnings from all sources and any amounts withheld to your income tax return. Simply add up all the amounts from Box 1 on all your W-2G forms and then list that total as “Other Income” on your Form 1040, Schedule 1. The same amount then goes on Line 7a of .

The second rule is that you can’t subtract the cost of gambling from your winnings. For example, if you win $620 from a horse race but it cost you $20 to bet, your taxable winnings are $620, not $600 after subtracting your $20 wager. You are not permitted to "net" your winnings and losses. Cash is not the only kind of winnings you .

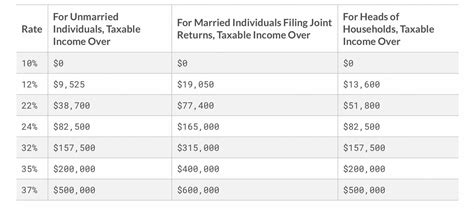

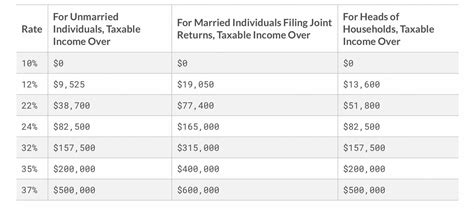

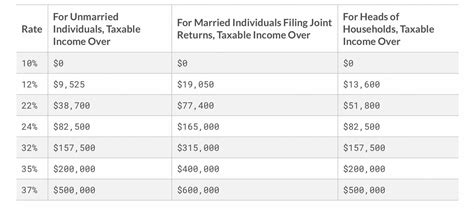

FanDuel Winnings and Taxes. If you win money on FanDuel, that money is considered taxable income. FanDuel is required by law to report any winnings of $600 or more to the IRS. This means that if you win more than $600 in a calendar year on FanDuel, you’ll receive a Form 1099-MISC from the platform, which you’ll need to include in your tax . Gambling Win Amount. Tax Paid on Gambling Winnings. $ 0. Calculate Total After Taxes. You Keep From Your Gambling Winnings. $ 0. Note:Tax calculator assumed a standard deduction of $12,400 (single)/$24,800 (married) and does not include any municipal/local taxes. Deposit Match up to $1,000 + $25 On The House. Bonus . Gambling winnings are typically subject to a flat 24% tax. However, for the activities listed below, winnings over $5,000 will be subject to income tax withholding: Any lottery, sweepstakes, or betting pool. Any other bet if the proceeds are equal to or greater than 300 times the wager amount.

Sports Betting Taxes: How They Work, What's Just check the app for the tax forms and see. Sports bets credit your losses against the wins. So if you won a $7k prize, but have wagered $5k, you will only be showing $2k as taxable income. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I..

FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off-track betting, bingo, or slot machines; any winnings over $1200 from keno games; and, all winnings over $5000 from poker tournaments. It’s important to understand the .

The state tax rate in Virginia ranges from 2% to 5.75%, which is the rate your gambling winnings are taxed. Are Gambling Winnings Taxable in Virginia? Yes, whether those came on sports bets, slot machines, pari-mutuels, poker or the lottery, those winnings are taxable. Even if the winnings were piled into your sportsbook account .aronnov. • 3 yr. ago. so my understanding is the current tax code sucks.. my understanding is that if you just put in $100 in your account. made thousands of bets many times over and winnings of $11,600 but your wagers were $11,000. despite only having a net profit of $600 you owe taxes on the 11,600. If you itemize your taxes (which almost .

How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel .The Player Activity Statement is a larger view of your overall use of FanDuel, with winnings, financial transactions and more. DISCLAIMER - We strongly recommend that you consult with a professional when .

© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources. Topic no. 419, Gambling income and losses. The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. Gambling winnings are subject to a 24% federal tax rate. In New York, state tax ranges from a low of 4% to a high of 8.82%. The higher your taxable income, the higher your state tax rate. A breakdown of tax rates for . A: For 2022, sports betting winnings are reported as Other Income on Schedule 1 (Form 1040) as gambling winning on line 8b. This amount flows to Form 1040, line 8, titled ‘Other Income,’ and is included in your final Adjusted Gross Income (AGI) calculation. If you are using itemized deductions, you can deduct your gambling losses .The 51% rate on gambling operator’s revenues tops every other US state and NY bettors can pay up to 12.7% tax on winnings as well as handing a chunk to the IRS. Gambling winnings have a 24% federal tax rate applied to them. New York State tax rates vary from 4% to 10.9% depending on annual income. The higher your taxable income, the higher .

fanduel winnings taxed|Sports Betting Taxes: How They Work, What's

PH0 · What Taxes Are Due on Gambling Winnings?

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Tax Considerations for Fantasy Sports Fans

PH3 · TVG

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · Sports Betting Taxes: How They Work, What's Taxable

PH6 · Sports Betting Taxes: How They Work, What's

PH7 · How Much Taxes Do You Pay On Sports Betting?

PH8 · Frequently Asked Questions

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH10 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel